Georgia payroll tax calculator 2020

Rates include an administrative assessment of 006. Get Started With ADP Payroll.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Paycheck Results is your gross pay and specific.

. After a few seconds you will be provided with a full breakdown. This includes tax withheld from. Employers have to pay a matching 145 of Medicare tax but only the.

Features That Benefit Every Business. Ad Process Payroll Faster Easier With ADP Payroll. This guide is used to explain the guidelines for Withholding Taxes.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Georgia Bonus Tax Percent Calculator Results. The Georgia Department of Labor is responsible for unemployment wages for the state of Georgia.

The maximum an employee will pay in 2022 is 911400. Free for personal use. For any wages above 200000 there is an Additional Medicare Tax of 09 which brings the rate to 235.

Ad Process Payroll Faster Easier With ADP Payroll. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Find out if you qualify for the ERTC Tax Credit.

In the income box labelled 1 enter the annual salary of 10000000. Your household income location filing status and number of personal. Georgia new employer rate.

Georgia state has a population of just under 11 million 2020 and over half of its population live in its capital city Atlanta. The median household income is 56183 2017. Withholding tax is the amount held from an employees wages and paid directly to the state by the employer.

If you want to simplify payroll tax calculations you can. Check the 2020 Georgia state tax rate and the rules to calculate state income tax 5. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Based Specialists Who Know You Your Business by Name. Below are your Georgia salary paycheck results. Ad Payroll So Easy You Can Set It Up Run It Yourself.

2022 Employers Tax Guidepdf 155 MB 2021 Employers Tax Guidepdf 178 MB. 9 per year of the underpayment use Form 600 UET to compute the penalty and 5 of Georgia income tax imposed for the taxable year-48-7-120 and 48-7-126 The combined total of the. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Get Started With ADP Payroll. Calculate your state income tax step by step 6. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

Important note on the salary paycheck calculator. Georgia Taxable Wage Base. Ad Compare This Years Top 5 Free Payroll Software.

Georgia SUTA wage base limit for 2020 is 9500. In the field Number of Payroll Payments Per Year enter 1. All Services Backed by Tax Guarantee.

Free Unbiased Reviews Top Picks. The results are broken up into three sections. The tax calculator will automatically calculate the.

Payroll Taxes Taxes Rate Annual Max. Ad Payroll Made Easy. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate. The Georgia State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Georgia State Tax CalculatorWe also provide State. For 2022 the minimum wage in Georgia is 725 per hour.

To use our Georgia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Ad Find out if you qualify for an ERTC Tax Credit. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State.

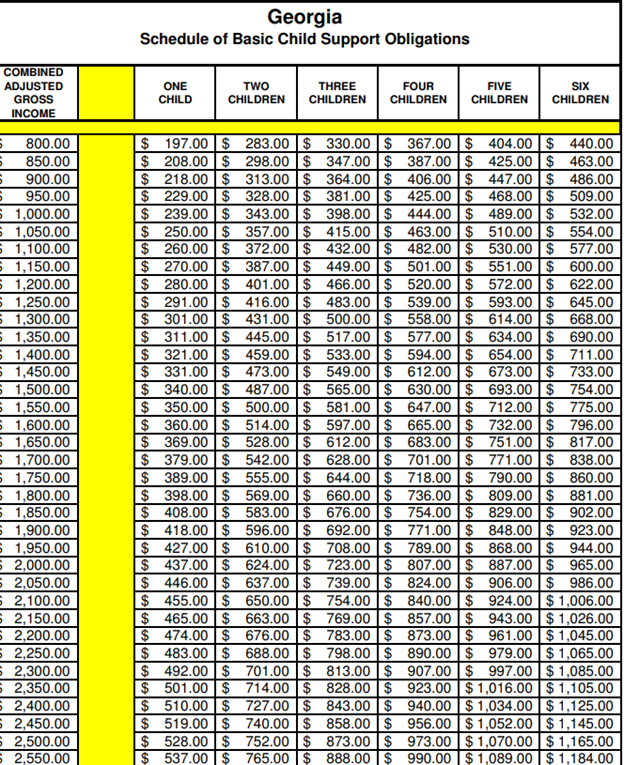

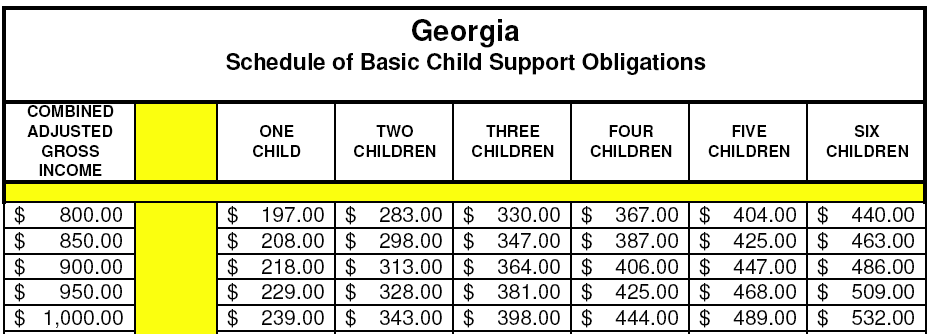

Child Support Va Calculator Cheap Sale 55 Off Www Ingeniovirtual Com

Georgia Tax Tables Georgia State Withholding 2021

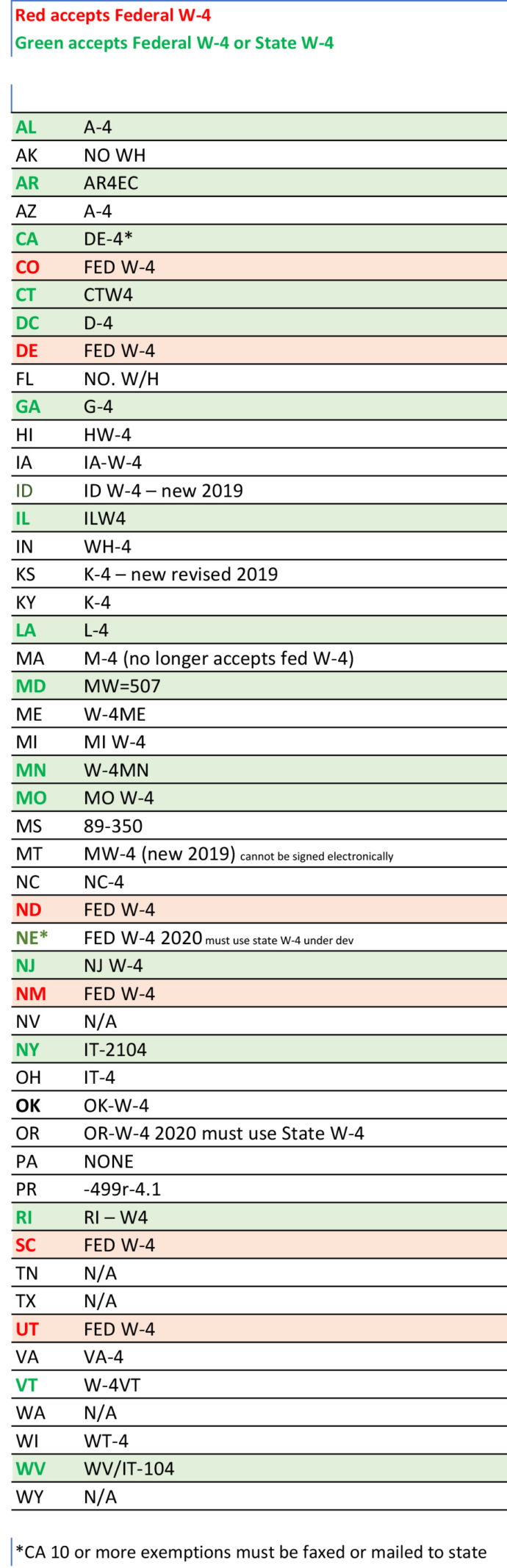

Federal And State W 4 Rules

Payroll Tax Calculator For Employers Gusto

Georgia Child Support Laws Recording Law

Georgia Paycheck Calculator Smartasset

Georgia Tax Calculator

Georgia Sales Reverse Sales Tax Calculator Dremploye

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Georgia Paycheck Calculator Tax Year 2022

Georgia Paycheck Calculator Smartasset

How To Calculate Child Support In Georgia 2018 How Much Payments

Tax Withholding For Pensions And Social Security Sensible Money

How To Calculate Payroll Taxes For Your Small Business

Georgia Salary Calculator 2022 Icalculator

Child Support Calculator Clearance 54 Off Www Aboutfaceandbody Net